A Decade-Plus Journey: The Fascinating History of Bitcoin

Bitcoin, the world’s first cryptocurrency, has a storied history that has captivated the imagination of individuals, investors, and technophiles around the world. From its enigmatic creation by the pseudonymous Satoshi Nakamoto to its enduring impact on the global financial landscape, the history of Bitcoin is a tale of innovation, intrigue, and transformation. In this article, we embark on a journey through the key milestones in the history of Bitcoin, spanning over a decade.

The Genesis: The Birth of Bitcoin

The story begins with the release of the Bitcoin whitepaper by an individual or group using the pseudonym “Satoshi Nakamoto” in October 2008. This whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlined the concept of a decentralized digital currency that operated without the need for intermediaries like banks or governments. The whitepaper introduced the foundational concepts of blockchain technology, mining, and the proof-of-work consensus mechanism.

In January 2009, Satoshi Nakamoto mined the first block of the Bitcoin blockchain, known as the “genesis block,” and embedded a message referencing a headline from The Times: “Chancellor on the brink of second bailout for banks.” This message highlighted Bitcoin’s primary goal: to offer an alternative to the traditional financial system that was marred by centralization and bailouts.

Early Days: Bitcoin’s Growth and Adoption

In its initial years, Bitcoin was a niche interest among cryptography and computer science enthusiasts. Early adopters began mining and trading Bitcoin, and its value was virtually negligible. By May 22, 2010, a momentous event took place when a programmer named Laszlo Hanyecz made the first recorded purchase using Bitcoin. He famously traded 10,000 bitcoins for two pizzas, marking the first real-world transaction with the cryptocurrency.

As Bitcoin’s network and community grew, more use cases emerged. It became a means of transferring value across borders, evading capital controls, and serving as a store of value. Online marketplaces and businesses started accepting Bitcoin as payment for goods and services, further propelling its adoption.

Mt. Gox and the Volatility Rollercoaster

One of the most significant milestones in Bitcoin’s history was the rise and fall of Mt. Gox, once the largest Bitcoin exchange in the world. The exchange experienced rapid growth but ultimately suffered from security breaches and insolvency. In February 2014, Mt. Gox filed for bankruptcy, causing substantial losses for its users and sending shockwaves throughout the Bitcoin community. This event underscored the need for greater security measures and the importance of responsible custodianship in the cryptocurrency space.

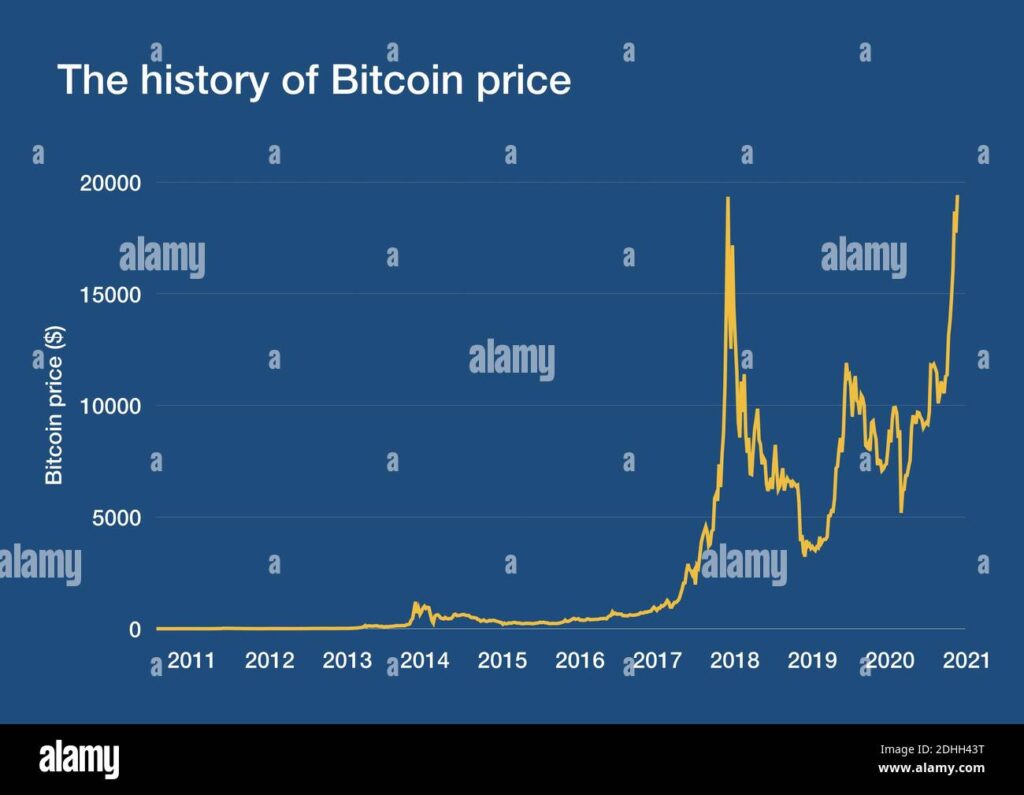

Bitcoin’s early years were also characterized by extreme price volatility. From fractions of a cent in its early days, Bitcoin’s price surged to over $1,000 in late 2013, only to experience a significant crash. The market’s unpredictability made headlines and fueled debates over whether Bitcoin was a bubble or a transformative asset class.

Emergence of Altcoins and the Scaling Debate

As Bitcoin’s popularity increased, so did the development of alternative cryptocurrencies, commonly referred to as “altcoins.” Many of these altcoins aimed to address perceived shortcomings in Bitcoin, such as scalability and privacy. Litecoin, created by Charlie Lee in 2011, was among the first notable altcoins. It introduced faster transaction confirmation times and a different hashing algorithm.

The scalability debate within the Bitcoin community was another key chapter in its history. Concerns about the network’s ability to handle a growing number of transactions led to discussions about potential solutions. Segregated Witness (SegWit) and the Lightning Network emerged as proposed scaling solutions to increase Bitcoin’s capacity and reduce transaction fees.

Regulatory and Institutional Interest

As Bitcoin continued to mature, governments and regulatory bodies worldwide began to take an interest in the cryptocurrency. Various countries enacted regulations and tax guidelines for Bitcoin, attempting to balance consumer protection with innovation. Regulatory clarity remained an ongoing issue for the cryptocurrency industry.

In parallel, institutional investors started showing interest in Bitcoin. The launch of Bitcoin futures contracts on the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE) in December 2017 marked a significant milestone in legitimizing Bitcoin as an asset class. These developments paved the way for greater institutional involvement and the entry of hedge funds, family offices, and large corporations into the cryptocurrency space.

The Bull Runs and Mainstream Recognition

Bitcoin’s price witnessed several remarkable bull runs, attracting global attention and investor interest. The most notable of these bull markets occurred in late 2017 when Bitcoin’s price reached an all-time high of nearly $20,000. However, this was followed by a significant market correction.

In 2020 and 2021, Bitcoin experienced another impressive bull run. A combination of factors, including growing institutional investment, the economic impact of the COVID-19 pandemic, and increasing adoption, contributed to Bitcoin’s price surge. The cryptocurrency reached new all-time highs and gained recognition from well-known investors and companies.

Bitcoin’s Future: Uncertainty and Potential

As Bitcoin’s history unfolds, its future remains uncertain yet filled with potential. Some key aspects of Bitcoin’s future include:

Regulatory Developments

The regulatory landscape for cryptocurrencies continues to evolve, impacting Bitcoin’s use and adoption. Clarity and consistency in regulations are essential for the cryptocurrency to grow while maintaining trust and compliance.

Institutional Investment

Institutional investment in Bitcoin is likely to expand, offering more credibility and stability to the market. Cryptocurrency-focused financial products and services will become more accessible to mainstream investors.

Technological Advancements

Ongoing technical developments, such as the Lightning Network, aim to enhance Bitcoin’s scalability and utility for everyday transactions. These innovations could further cement Bitcoin’s position in the financial ecosystem.

Adoption as a Store of Value

Bitcoin’s narrative as “digital gold” and a store of value is expected to persist. It will continue to attract individuals and entities looking for an inflation-resistant asset and a hedge against economic uncertainty.

Environmental Concerns

Environmental concerns related to Bitcoin mining energy consumption are an ongoing topic of discussion. Efforts to make mining more energy-efficient and sustainable are expected to continue.

In conclusion, the history of Bitcoin is a captivating journey marked by innovation, volatility, and transformation. From its mysterious creation in 2008 to its role as a recognized global asset, Bitcoin has made a lasting impact on the financial world. While its future remains uncertain and subject to ongoing developments, one thing is certain: Bitcoin’s history is far from over, and its story continues to unfold as it shapes the future of finance.