Unraveling Bitcoin Price and Market Dynamics: A Comprehensive Analysis

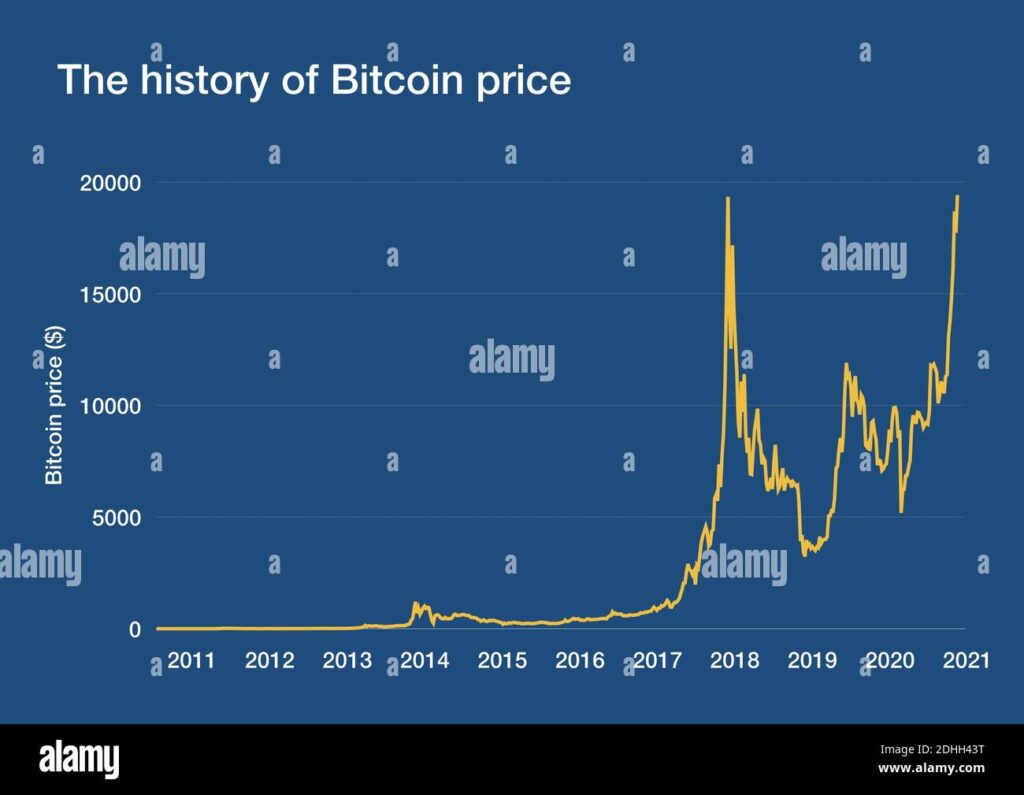

The cryptocurrency world has experienced seismic shifts and astounding growth over the past decade, with Bitcoin leading the charge as the pioneer and most recognized digital asset. One of the most compelling aspects of Bitcoin for enthusiasts and investors is its price and market behavior. In this article, we will delve into the intricacies of Bitcoin’s price and the dynamics of its ever-evolving market.

The Genesis of Bitcoin’s Price

To understand Bitcoin’s price, we must begin with its creation and the factors that initially influenced its value. Bitcoin was introduced in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto. Its initial value was negligible, with early enthusiasts mining or purchasing it for a few cents per Bitcoin. Several key factors have contributed to its price growth:

1. Scarcity: Bitcoin’s design includes a maximum supply of 21 million coins, which creates a sense of scarcity similar to precious metals like gold. This scarcity has driven demand and value.

2. Adoption: As more individuals, institutions, and businesses have adopted Bitcoin, its value has risen. Notable moments include major companies accepting Bitcoin as a form of payment and institutional investments in Bitcoin.

3. Technology and Innovation: Advances in blockchain technology and the development of decentralized finance (DeFi) applications have added to the utility and value of Bitcoin.

4. Market Speculation: Speculation has played a significant role in Bitcoin’s price. Traders and investors seek to capitalize on price fluctuations, contributing to both upward and downward movements.

The Volatility of Bitcoin

Bitcoin’s price is known for its volatility. It can experience rapid and significant price swings over short periods, which can be attributed to several factors:

1. Market Sentiment: Bitcoin’s price is highly influenced by market sentiment. Positive news, regulatory developments, or institutional endorsements can lead to bullish sentiment, while negative events can trigger bearish sentiment.

2. Liquidity: Bitcoin’s relatively low market capitalization compared to traditional assets makes it more susceptible to price manipulation and sudden large trades.

3. Lack of Regulation: The lack of comprehensive regulation in the cryptocurrency market allows for more freedom but also introduces greater uncertainty.

4. Global Factors: Geopolitical events, economic crises, and macroeconomic trends can affect Bitcoin’s price, as it is often viewed as a safe-haven asset.

Bitcoin as a Store of Value

Bitcoin’s price and market dynamics have led some to view it as a potential store of value, similar to gold. Several factors contribute to this perspective:

1. Scarcity: Bitcoin’s limited supply, with a maximum of 21 million coins, mirrors the scarcity characteristics of precious metals.

2. Digital Gold: Bitcoin is often referred to as “digital gold” due to its ability to store value and serve as a hedge against inflation and economic uncertainty.

3. Institutional Investment: Major institutions, including investment firms and publicly traded companies, have started to allocate significant portions of their portfolios to Bitcoin.

4. Decentralization: Bitcoin’s decentralized nature and resistance to censorship make it appealing for individuals and entities seeking to store value outside traditional financial systems.

Bitcoin’s Role in the Broader Crypto Market

Bitcoin is often seen as the bellwether of the cryptocurrency market. Its price and market movements often set the tone for other digital assets. Here’s how Bitcoin relates to the broader crypto market:

1. Dominance: Bitcoin’s market dominance, often measured by its share of the total cryptocurrency market capitalization, impacts the market sentiment for other cryptocurrencies. When Bitcoin performs well, it can drive positive sentiment throughout the market.

- 2. Trading Pairs: Bitcoin serves as a primary trading pair for many other cryptocurrencies. Traders often use Bitcoin to buy or sell other assets, contributing to its overall market influence.

- 3. Institutional Influence: Institutional investments in Bitcoin can lead to greater acceptance and adoption of cryptocurrencies in general.

- 4. Altcoin Seasons: The cryptocurrency market often experiences cycles known as “altcoin seasons,” where smaller cryptocurrencies outperform Bitcoin. These events are closely monitored by traders and investors.

The Future of Bitcoin’s Price and Market

Predicting the future of Bitcoin’s price and market behavior is a complex endeavor. Bitcoin’s unique characteristics, including its scarcity and decentralized nature, make it a compelling asset. However, market dynamics, regulatory changes, and global events will continue to play a role in shaping its future.

As the cryptocurrency ecosystem evolves, it is essential to stay informed about market trends, technological developments, and regulatory changes. Whether you are an investor, trader, or simply interested in the world of cryptocurrencies, understanding the dynamics of Bitcoin’s price and market behavior will be crucial to making informed decisions and navigating this exciting and ever-changing landscape.